A special feature by RMIT journalists by Patrick Doyle, Lulu Graham, Ruby Littler and Ché Parisi

On the steps of Parliament House, a group of people hold signs calling for public housing reform.

Melburnians walking along Spring Street on any given Thursday over the past ten years might have noticed this crew.

As Melbourne’s housing crisis worsens, their presence only gets stronger and their voices grow louder. And the inner western suburbs are at the epicentre of the crisis.

In suburbs like Maribyrnong and Footscray, large plots of land sit dormant for years, sometimes decades. These plots are not vacant by happenstance but rather part of an investor practice known as land banking.

Despite fighting for reform for over a decade, rally leader Dr Joseph Toscano feels their cries have fallen on deaf ears.

“The promise of public housing is like a pie in the sky,” Dr Toscano said.

In Victoria, the amount of allocated public housing dwellings just can’t keep up with ever growing waitlists.

Public housing, social housing and community housing are all different. Public housing is entirely state owned, state managed and “intended to provide a sense of long-term security for tenants” says Dr Toscano.

“People say it’s just semantics, but these semantics have a profound impact on people’s lives. Countless Victorians not having roofs over their heads.”

The impact of land banking

This situation is made even more challenging by land banking: an investment practice where large plots of land are purchased and sold in parcels at a profit. Most of the time it’s empty land, brimming with potential to house thousands of residents.

Beneath the surface of this common real estate strategy lie claims of unregulated, non-transparent practices, shrouding land banking in shades of grey.

Woodlea Estate, Atherstone, and Manor Lakes are just a few western suburb developments caught in the crossfire. Less than a quarter of land banked sites in these areas had been sold over a period of nine and half years, according to a 2022 Prosper Report.

However, land banking can be a lucrative practice for developers. In the current market, it’s loosely regulated with the potential for high reward. These developers can leverage the demand for housing and the growth rate of median property prices.

According to Property Update, the west is home to several of Melbourne’s fastest growing suburbs. These include Truganina, Tarneit, Point Cook, Melton South and Wyndham Vale with buyers hoping to secure a home in an area that is still comparatively affordable.

But property developers and investors are quick to respond to the demand resulting in higher prices for both vacant lots as well as house and land packages. The Prosper Report indicates that land banking strategies have contributed to the rise.

One approach is to acquire a large plot of land with a long-term investment strategy in mind, holding on to the property for years to take advantage of the price increase of land as a commodity.

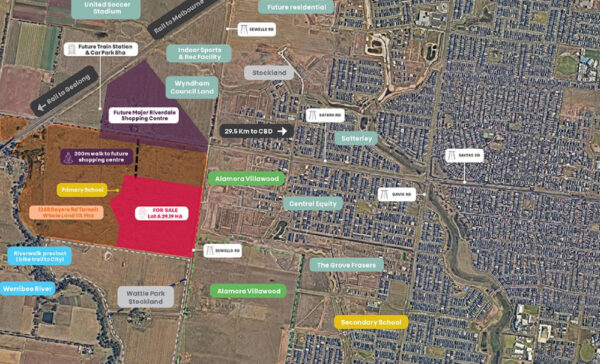

In September, property investor Seamus Walsh sold a 29 hectare lot to developer Urban Base for $83 million, as reported in the Australian Financial Review.

It’s unclear exactly when Mr Walsh became the owner of the entire property, but council documents list him as one of two landowners in 2012. Tarneit’s median vacant land prices increased by more than 85 percent between 2012 and 2022, according to Victoria’s Department of Transport and Planning, so this would have been a highly profitable investment.

Another strategy, which is that of more traditional land banking, is where subdivided land is sold as either a vacant land lot or as a land and house package.

In 2019, property developer Potter George purchased 12.68 hectares of land at 937 Melton Highway, Fraser Rise for $19 million, according to the Australian Financial Review. Google Maps street view images show construction began in 2021, meaning the plot remained unused for two years.

Acquiring one square metre for slightly less than $150 through the purchase, the group sold a 313 square metre vacant land lot one year later for $305,000. That’s an $825 increase per square metre, meaning on this one occasion for this one lot, approximately $258,100 was added to the original lot purchase price. It should be noted, however, that this figure is not reflective of profit alone with residential allotment costs, ancillary expenses and taxes incurred.

There were 196 lots in this project.

Who’s pocketing the profits from the sale of public land?

Concerned about the ability for developers to acquire large vacant plots is Jorge Jorquera, a Maribyrnong socialist councillor, who has noticed a connection between land banking and surplus government land.

“The state government sells government land to property developers who sit on it and wait for the maximum market profits. This was originally government land. They could have developed public housing from the outset,” Cr Jorquera said.

While the land Potter George purchased wasn’t surplus government land, there is evidence this type of land is being acquired by developers to build private properties.

A site on Kororoit Creek Road, Williamstown, was sold as government surplus land in 2017 for $4.5 million. Previously belonging to VicRoads, the plot is to be subdivided into 18 lots for townhouse development. A recent Jellis Craig listing for one of the planned four bedroom townhouses has an asking price of $1.5 million.

Cr Jorquera said these types of developments promise higher profits than creating affordable housing, even with the government’s capital gains tax (CGT) discount of ten per cent.

These land banking practices have contributed to the gentrification of the area which has seen a significant growth in median house prices. The mean increase across all western suburbs is 18.2 percent making it more difficult for desperate tenants to buy into the housing market.

But developers and property investors aren’t the only ones implicated in holding on to land which could be used for public housing.

Maribyrnong City Development Special Committee Meeting minutes from 2016 reveal an intention for the local council to purchase land parcels at 4-6 Whitehall Street, Footscray.

These purchases were enacted in 2020 and 2021 for a total of $1,474,000, according to publicly available government land sales records.

The plots were vacant at the times of purchase and have remained unused until relatively recently. Mayor of Maribyrnong, Sarah Carter, says the property is currently being developed and is expected to be open to the public in early 2024.

Cr Carter says council is taking active steps “to work with developers” to “encourage activity” on land banked sites in the municipality but was unable to disclose the names of these developers or the land banked sites.

“Council is supportive of more social and public housing, but it should be noted that the responsibility of providing and managing public housing belongs at the state level of government,” she says.

On September 19 2022, then Premier Dan Andrews announced a package to boost housing supply affordability by building 800,000 homes in the next 10 years.

However Dr Toscano says the plan shows the government does not understand the issue at hand.

“Everyone’s so grateful about this new housing policy but the words public housing were not mentioned once in the whole thing,” Dr Toscano said.

Cr Jorquera shares similar sentiment, fearing these initiatives contribute to “driving the privatisation of public housing”.

The typical Australian dream of owning a house is no longer a reality for most, with some failing to attain liveable housing due to land banking.

There are multiple stakeholders with varying agendas and priorities. It will take time and bi-partisan negotiations to navigate this complicated issue.

In the meantime the cost of owning or renting a home continues to go up, as does the number of people facing homelessness.